The Franchise Disclosure Document (FDD) in Detail

Franchisors are Required to Provide a Presale Disclosure Document (FDD) to Prospective Franchisees

The U.S. Franchise Rule requires that franchisors provide to prospective franchises the presale disclosure document (“FDD”) to prospective franchisees so that they can make an informed decision prior to entering into a franchise relationship. According to the FTC, the Franchise Rule is “designed to enable potential franchisees to protect themselves before investing by providing them with information essential to an assessment of the potential risks and benefits, to meaningful comparisons with other investments, and to further investigation of the franchise opportunity.”

- Timing: Franchisors must provide the FDD to prospective franchisees at least fourteen days prior to them signing the franchise agreement, and the franchisee is entitled to receive the completed Franchise Agreement at least seven days prior to signing it. Of course, as in any rule there are some conditions to these requirements at the federal and state level, but I am going to gloss over them here because they are a bit too technical for this type of article. The MSA Worldwide website provides a as a convenient reference for franchisors to calculate the disclosure timing requirements mandated by FTC regulations and various state laws.

- Language: The Franchise Rule also requires that the disclosure portion of the FDD be written in “Plain English” – not in legalese – and provide the potential franchisee with specified categories of information about the franchisor and the franchise offering. These categories include information about the franchisor’s business, the terms of the relationship, and the rights and obligations of the license, sufficient for prospective franchisees to make an informed decision before entering into a franchise relationship. While some U.S. states require that franchisors file or register their FDD with the state before offering franchises, no such requirement exists under the Federal Rule. So be sure to check your state’s requirements.

Information in the FDD falls into three general categories: information about the franchisor; information about the franchise system and the investment necessary to develop a location; and information about each party’s rights and obligations under the contract that they’re going to sign.

There are 23 Disclosure Items in a Franchise Disclosure Document

The disclosure document is prepared in a format established by the U.S. Federal Trade Commission (FTC). Under the FTC Franchise Rule, there are twenty-three specified areas of disclosure (called “Items” in franchise parlance) in the FDD, including a written receipt. All but one of these Items are required. The 23 Items are listed and described below:

- The Franchisor and any Parents, Predecessors, and Affiliates

- Business Experience

- Litigation

- Bankruptcy

- Initial Fees

- Other Fees

- Estimated Initial Investment

- Restrictions on Sources of Products and Services

- Franchisee’s Obligations

- Financing

- Franchisor’s Assistance, Advertising, Computer Systems, and Training

- Territory

- Trademarks

- Patents, Copyrights, and Proprietary Information

- Obligation to Participate in the Actual Operation of the Franchise Business

- Restrictions on What the Franchisee May Sell

- Renewal, Termination, Transfer, and Dispute Resolution

- Public Figures

- Financial Performance Representations

- Outlets and Franchisee Information

- Financial Statements

- Contracts

- Receipts

Item 1 – The Franchisor, its predecessors and affiliates

Describes the franchise company and certain affiliate companies, the business concept to be offered, the market for the product or service offered, known government regulations with which the franchisee must comply, and the competitors a franchisee may face in the business.

Item 2 – Business Experience

Professional experience:

- All Directors of the franchisor

- All senior management who have decision making responsibilities for the franchisor

Item 3 – Litigation

The franchisor must list specific litigation relevant to the franchise company, whether civil or criminal, pending or settled, whether they are plaintiff or defendant.

Item 4 – Bankruptcy

All senior management must disclose any personal bankruptcy or any corporate bankruptcy for a company of which they were a senior management officer during the past 10 years.

Item 5 – Initial Franchise Fee

The amount of the initial franchise fee, how and when it is to be paid, and under what circumstances, if any, the initial fee would be refunded to the franchisee.

Item 6 – Other Fees

All other fees (type of fee and amount) whether one-time fees, per occurrence fees, or on-going fees must be included in Item 6 along with information on how and when they are to be paid and under what circumstances, if any, the fee would be refunded. These fees could include but are not limited to:

- On-going royalties

- Advertising fund contribution fees - Local Advertising - Cooperative Advertising

- Initial training fees - Additional training fees

- Renewal fees - Transfer fees

- Public offering fees (security fees)

- Software usage or support fees

- Audit fees

- Additional field and other consulting fees

- Reimbursement of costs

- Other costs

- Does not include fees payable to third parties

Item 7 – Initial Investment

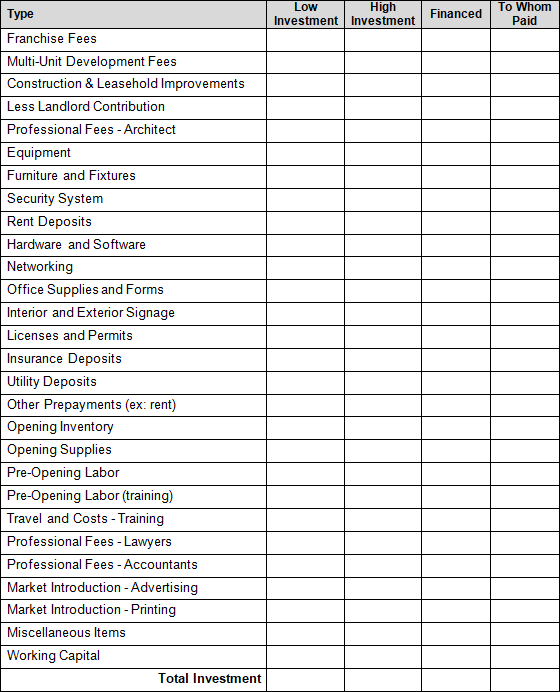

The franchisor must provide information on the franchisee’s total estimated investment to get started in the franchised business.

- Information is presented in a chart format and lists each category of expenditure and provides a low and high range of estimated expense. Typically, this range is based on the franchisor’s own experience in opening units of their business.

- Footnotes are used to explain the basis for the estimates.

In addition to the category of expenditure and the estimated range of expense, the chart also provides information on the method of payment, when the payment is made, to whom it is made and under what conditions, if any, it is refundable.

Below is the type of chart and information you will generally see:

Item 8 – Restrictions on sources of products and services

- If the franchisor wishes to control the products offered by the franchisee or the equipment and supplies used by the franchisee in the operation of the business, they must disclose the requirements.

- If the franchisor requires that the franchisee purchase from approved suppliers (including the franchisor or affiliate companies) or to certain specifications, that requirement must be disclosed.

- If the franchisor earns revenue from franchisee purchases, the amount that the franchisor earned in the previous year must be disclosed. The franchisor must also estimate the percentage of total purchases made by the franchisee to operate their business that are controlled by the franchisor.

Item 9 – Franchisee’s Obligations

The franchisee’s obligations in starting and operating the business. Format is a chart identifying the obligation and directing the reader to proper section of the franchise agreement or the FDD for details on the obligation.

Item 10 – Financing Available

The terms and conditions of any direct or indirect financing provided to the franchisee.

Item 11 – Franchisor’s Obligations

The obligations of the franchisor in supporting the franchisee. These obligations are typically divided into what services the franchisor will provide prior to the opening of the business, and those services the franchisor will provide on an ongoing basis.

Item 12 – Territory

If territorial rights are granted to the franchisee, they are described together with any performance criteria required of the franchisee for maintaining those rights.

Item 13 – Trademarks

The franchisor must provide information regarding their trademarks, service marks, and trade names that will be used by the franchisee in the business.

Item 14 – Patents, copyrights, and proprietary information

The franchisor must provide information regarding their patents, copyrights, and other proprietary information that the franchisee will use in the operation of the business.

Item 15 – Obligations to participate in the actual operation of the franchise business

Whether the franchisor requires the franchisee to be an owner-operator and devote full time to the operation of the business, or whether the franchisee may be an investor and turn the day-to-day operations over to a manager, along with any ownership, training, or certification requirements for the person who is responsible for operating the business.

Item 16 – Restrictions on what the franchise may sell

If the franchisor prohibits certain products or services to be offered by the franchisee, they must identify those requirements.

Item 17 – Renewal, termination, transfers, and dispute resolution

- The term of the franchise agreement including the number and length of renewal periods, if any

- Rights of the franchisee and franchisor to terminate the relationship – whether cause is required and, if so, what rights does the franchisor have to cure

- Rights and obligations of each party after termination or expiration of the agreement

- Rights of the franchisor to transfer or assign the agreement

- Rights of the franchisee to transfer or assign the agreement

- Rights of the franchisor to purchase the franchisee’s business

- In-term and post-term restrictions on the franchisee regarding involvement with competing businesses

- Manner by which the agreement can be modified

- Manner by which disputes between franchisor and franchisee will be settled

- Which state’s law will govern the contract

Item 18 – Public Figures

If the franchisor uses a celebrity or other public figure in the franchise name or logo, the amount the person is paid, their involvement in the management of the business, and their investment in the franchisor are disclosed.

Item 19 – Financial Performance Representation

- This is the only elective disclosure, but is critical information for the prospective franchisee to have. The majority of franchisors include an FPR disclosure.

- What the franchisor discloses in FDD Item 19 is substantially the only information that a franchisor or its agents or brokers is able to provide concerning profitability, sales, income, etc., of the proposed business.

- There are exceptions for unit costs, the sale of an existing business and supplemental information, etc.

- There are numerous ways of constructing an Item 19. Whatever information is provided must be accurate, verifiable, and relevant to prospective franchisee’s evaluation of the franchise opportunity.

- The franchisor must be willing to stand behind their Earnings Claim.

- Typically the franchisor cannot review a prospective franchisee’s business plans, as that might be construed as a Financial Performance

- Representation.

- The FPR disclosure will generally include substantial footnotes.

Item 20 – List of Franchise Outlets

The franchisor must provide the following information:

- Number of franchised and company-owned locations by state (immediate past 3 years)

- Estimated number of franchised and company-owned locations estimated to be opened in the next year

- Number of franchises terminated, transferred, or canceled

- Number of franchises that have not been renewed or that have been reacquired by the franchisor

- Number of franchisees that have ceased to operate

- Names and contact information for all franchisees and all franchisees who have left the system in the past year

- Contact information for independent franchisee association, under certain defined conductions

Item 21 – Audited Financial Statements – three years

Item 22 – Contracts

Every contract or agreement with the franchisor or its affiliated companies that the franchisee is required to sign. Copies of the actual agreements are attached as exhibits to the FDD.

Item 23 – Receipts for the FDD

- Everyone who is provided with a FDD must sign and date the receipt and return it to the franchisor.

- The franchisor is prohibited from accepting any money or signing any contract for a period of fourteen days from the date the FDD was delivered, or seven days from the date the actual franchise agreement to be signed by the franchisee is provided to them for their review. It is not enough to give the FDD to a prospective franchisee; the franchisor must be able to prove that the FDD was provided and when it was provided in court. Refer to MSA Worldwide’s Franchise Disclosure Compliance Calendar.

- The “Franchise Seller” must be listed on the receipt.

Franchisors should Prepare Carefully before Developing their Franchise Disclosure Document.

For franchisors, developing a Franchise Disclosure Document should be completed by qualified franchise lawyers and only after significant strategic and other business planning. The laws that regulate the franchising industry are different at the federal and state level. Additionally, each state has different laws that regulate franchising within its borders.

Some franchisors make the mistake of rushing into development of their legal documents, and short-change the strategic work of franchise system planning. But while the FDD Items that you need to disclose are predetermined by the FTC Rule, the information you put in those Items is unique to your brand, your franchise system. You don’t want to follow somebody else’s formula for a franchise system. The FDD provides you with a guide to the structure of a sustainable franchise system, but without exploring the strategic considerations that most of your decisions will require, your franchise system could end up operating as just a legal vehicle for expansion rather than what it truly should be – a business structure for sustainable expansion.

For an overview of which states require filing or registration, see our video How To Develop A Franchise System Part 10: Regulatory Framework. This video looks at compliance with the Registration and Disclosure laws applicable in 14 states, such as California, Illinois, New York, Virginia, Michigan, and others, and also examines the laws in detail related to an Item 19 disclosure, the Financial Performance Representation, and what type of statements could get you into legal trouble.

Do you have questions about franchise disclosure requirements?

MSA can provide guidance on planning a successful and sustainable franchise system. Contact us for a complimentary consultation.

Get Strategic Advice